TRAI reported at the start of 2012 that of the 147 million Indian TV households, 44 million were now DTH homes. Research by Media Partners Asia based in Singapore, indicated that the Direct-to-Home (DTH) industry grew by 77% over 2011 and Dish TV is the market leader at 28%, followed by Tata Sky at 18%, Airtel Digital TV and Sun Direct at 16%, Videocon at 11%, and Reliance BIG TV at 9.5%.

With the government's new Digitization Bill that requires compulsory digital set top boxes for televisions in Indian households, it appears that DTH companies will be the single biggest beneficiaries. The question really is which among the DTH players is likely to benefit the most?

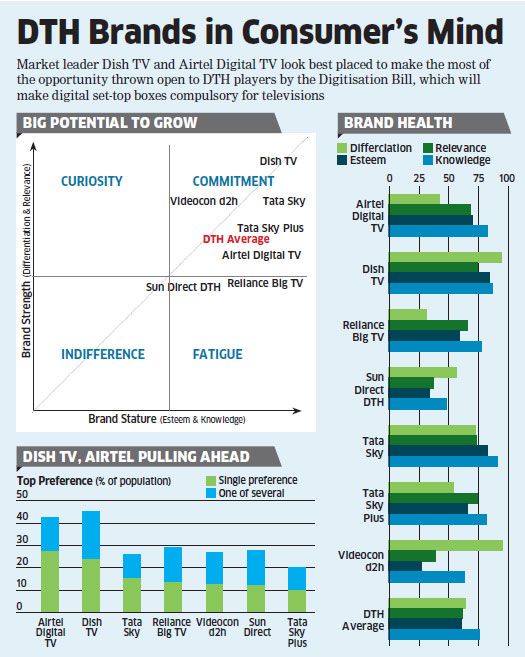

According to Rediffusion-Y&R's Brand Asset Valuator (BAV), a comprehensive tool that measures brand health among Indian consumers, Dish TV came through as the clear leader brand in the DTH space. The other brands that lead the category are Tata Sky, Tata Sky+, and Videocon d2h. Airtel Digital TV also finds itself in placed in the crowd, only lagging slightly. From this, it appears that the battle for DTH household ismost likely going to be fought amongst these four players.

It is noteworthy how DTH brands have fared in the minds of the customer. The two players who have successfully built Differentiation, which is a compelling proposition that stands out in the mind of the customer, are the market leader Dish TV and the late entrant Videocon d2h.On the other hand, early mover Tata Sky enjoys the highest awareness (Knowledge Pillar) and regard (Esteem Pillar) among consumers. And if you look at the category on the whole, you see that there is higher Brand Stature (Esteem, Knowledge) rather than Brand Strength (Differentiation, Relevance), implying that this is a well-established category with potential to grow further.

DTH is associated with strong technology values like "High Quality," "Trust," and "Reliability". Additionally, the rapid growth and acceptance of DTH has led to associations with concepts like "Energetic," "Trendy," and "Unique." Individual brands, too, have distinct associations that keep them in the commitment quadrant. While the market leader Dish TV stands for "Uniqueness" and "Popularity," its closest challenger Tata Sky has the 'Good value' association. Newer players like Airtel Digital TV and Videocon d2h are seen as 'Customer Caring' and 'Innovative',respectively. While this indicates distinct branding in the category, which of these associated values are the ones that will truly drive 'Preference' among consumers? This is the most critical parameter to watch for at a time when DTH stands to gain maximum share as a category. The BAV throws light on how imagery can drive preference and consideration within the category.

When it comes to 'Total Consideration' scores, Dish TV leads the pack, followed by Airtel Digital TV. Forty-five percent of households clearly see Dish TV in their consideration set. Surprisingly, early-mover brands like Tata Sky are seen lower on the consideration scale. While total consideration scores allow for a brand to be in the mindspace of the consumer, it is being the top preference that will drive a particular brandforward in a competitive category.

In the "My Single Preference" versus "One of my several options" battle of the brands, Airtel Digital TV takes the lead. Most consumers see AirtelDigital as their destination of choice. This is also true, but to a lesser extent, for market leader Dish TV, and even lower for its challenger Tata Sky. Another part of the Preference jigsaw is the resistance shown towards certain DTH brands. Tata Sky+ is the brand most customers would never consider as an option. Airtel Digital and Dish TV are avoided the least, with only 25%of customers never considering these two brands as options.