New Delhi October 17, 2011: The ordinance to push through cable digitisation is not a game changer, it is just a beacon of hope.

Take a break from the celebrations. The ordinance to push digitisation of cable in India, approved by a Cabinet committee last week, is not going to end the troubles of the television industry. All it does is giving hope for full digitisation. This hope may even get fulfilled. Not because cable companies are quick on their feet, but because direct-to-home (DTH) operators could use this opportunity.

Think about it. In five years, without an ordinance, without any sops, six direct-to-home or DTH operators have already invested over $3 billion in making a base of 40 million digital subscribers.

That is half the cable TV homes and 30 per cent of the total TV homes in India. Another couple of billion dollars and they could be dominating the market for digital pay TV, instead of cable. Most are eyeing the coming months with relish. "The top two-three (DTH) companies are generating enough cash to fund future acquisition of consumers. So we are well-placed," says R C Venkateish, CEO, Dish TV, India's largest DTH operator.

Watch out then for a battle between the 'struggling to meet the deadline,' cable industry and 'been there-done that' DTH one, in the four metros which have to be digital by March 2012. The story will be repeated across the country, which the ministry of information and broadcasting reckons should be digital by December 2014.

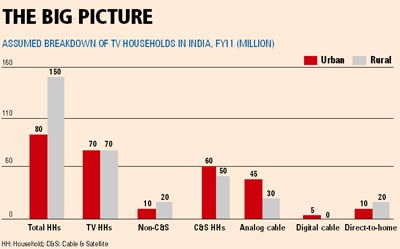

So this ordinance will hurry the process of digitising all of India's 142 million TV homes. Whether cable companies get a bulk of them or DTH operators do, is another question. That is in the short term. Over a longer term it will mean, an increase in consumer pay outs. It will also improve advertising rates. Eventually the Rs 32,000 crore Indian TV industry should morph into a more profitable business.

Why an ordinance?

If digitisation of cable is so good for everyone why did it take an ordinance to push it through?

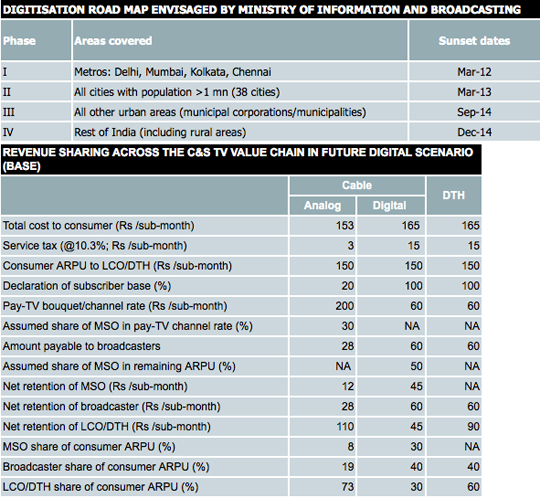

Just about 15-20 per cent of the Rs 15,000-crore cable operators collect from you, comes back to broadcasters. For years cable operators 'under declared' and broadcasters negotiated 'better declarations'. In the past five years however, growth in ad revenues, that brings in 80 per cent of the topline, had slowed down. And carriage fees, the amount the trade charges to carry a channel doubled. As a result, operating margins for Indian broadcasters have halved.

In the meanwhile, DTH took off. Inspite of its smaller base — 40 million homes against 80 odd million for cable — DTH now contributes more to pay revenue for broadcasters than cable (see table). This drove home the point of what digitisation can do — to both broadcasters and regulators.

That is when broadcasters started pushing for it. But in a market where multi-system operators (MSOs), the distributors of the TV signal made a bulk of their money from carriage fees and the cable operators paid next to nothing, there was resistance.

"The ordinance is a welcome step because some of the players in the value chain had no motivation to do this otherwise," says Gaurav Gandhi, chief operating officer, Sun 18 Media services, North.

It essentially changes a section of the Cable Television Networks Act of 1995 that allowed analog cable to co-exist with digital. This was used by cable operators and MSOs to digitise in name only, with cardless, unaddressable systems. So in spite of the 2002 CAS amendment to the Cable Act, only about a couple of million cable homes have a digital set-top-box. Now it is mandatory to provide all channels through an 'addressable digital set top box.' "This ordinance has teeth," says Vivek Couto, executive director, Media Partners Asia (MPA).

The challenges

It needs some muscle too. MPA estimates that the cost of digitising all TV homes at $3-3.5 billion. The first four cities alone will take about $150 million for seven million non-digital cable homes.

MSOs are demanding a tax holiday, easing of import duties on equipment and relaxing price regulation. The Telecom Regulatory Authority of India (Trai), the broadcast regulator, supports these.

However, many of these decisions vest with the ministry of finance. Therefore things are unclear for now. "With or without all the other things this will work. Whoever is complaining is simply not ready," says Yogesh Radhakrishnan, managing director and CEO, Media Network and Distribution, a joint venture between Radhakrishnan and Bennett, Coleman.

Readiness is in fact a worry. "Seeding seven million boxes won't be a walk in the park," says Gurjeev Singh Kapoor, COO, Media Pro, a distribution joint venture between Star and Zee. It needs money and a will to do it. The ordinance provides the will. The money might be a problem. Most investors are not very sure about cable's ability to pull this off.

At a forum in Mumbai last week, at least two investors were scathing in their comments about cable's inability to pick up the digitisation gauntlet. Cable company CEOs such as K Jayaraman of Hathway were talking about raising long-term debt instead of diluting equity. There was also talk of getting banks to treat loans to cable companies as project finance instead of regular debt.

This seems like more agonising. More so when you know that DTH companies have gone and spent capital successfully. You could argue that unlike cable firms, they did not have to worry about owning the last mile. For long there has been talk of licensing cable to make ownership of the last mile clearer. Even if that doesn't happen, Kapoor points out that the fact of placing the box in the consumer's house makes the MSO the owner of the last mile. It makes it harder for the operator to shift MSOs.

Less ad breaks

There is some talk that full digitisation could cause ad revenues to fall in the long run as real reach figures for channels come out. "Consumer behaviour does not change dramatically with digitisation, we know that (from TAM studies on digital homes). I don't think that full digitisation will change the pecking order of the top networks and channels in any major way," says Uday Shankar, CEO, Star India.

In fact with better pay revenues, broadcasters will have the gumption to stick to the 10 minutes of advertising per hour norm more strictly. This means less advertising inventory and higher rates, especially for the leading channels. But just like their American counterparts, "(Indian) broadcasters must invest the extra margins back into the business, in content," says Couto.

"My biggest concern is that people have got used to taking regulation casually in this country. The MIB has done a great job of pushing for this. There will be several attempts to delay it, through legislation, etc. It should not lead to the chaos that was caused in the past," says Shankar.

Even without litigation chaos could happen. A wireless telco, say Reliance, could just change the whole game by offering TV signals on Rs 5,000 iPad-like devices. What earthly use will an ordinance be then?