The planned initial public offering (IPO) of Taiwan-based Asian Pay Television Trust on the Singapore stock

market has attracted at least nine foreign investors and cumulative investment of almost SGD451mn. With

one third of the 1.44bn shares already allocated and at the top end of the price range, it is clear that the

offering has the potential to become one of the biggest listings in Singapore in recent times. Besides putting

the operator in a better financial position from which it can counter competitive threats, investors' confidence

reflects broader interest in Asian investment trusts and bodes well for future floatations, particularly in the real

estate sector where data centre developers are based.

In a prospectus filed with the Monetary Authority of Singapore, Asian Pay Television identified its cornerstone

investors as being Quantum Vehicle (a company controlled by financier George Soros), Eastspring

Investments (a Prudential investment vehicle), hedge fund Och-Ziff Capital Management Group , Signature

Global Advisors , Lion Global Investors Ltd , Indus Capital Partners , Capital Research and Management

Company , Asian Century Quest Capital and Neuberger Berman .

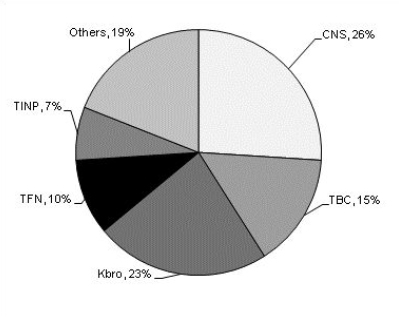

Crowded Market

Taiwan Cable

TV Market Share, Q412

Interest in trusts as rapid-growth investments is booming, particularly in Singapore, which has played host to

a number of high-profile listings in recent months, including the US$1.3bn offering of a China-focused real

estate investment trust (REIT) by Mapletree Investments Pte . Trusts are viewed as being safe investments

and, at a time when low interest rates prompt investors look for potentially large yields, so there is strong

demand for those that demonstrate a clear growth trajectory.

Taiwan Broadband Communications (TBC) currently owns the pay-TV assets that are being contributed to

Asia Pay Television Trust. Funds managed by Australia-based Macquarie Group will remain investors in both

businesses, ensuring continuity of operations and strategy and retaining historic links between the pay-TV

operation and the broadband and telephony businesses of TBC. At the same time, however, owing to the

separation of the management of the two businesses, it will be easier for each to independently serve the

wholesale access market. With Taiwanese consumers increasingly looking for the best service bundles, such

a move is important to future growth prospects.

Taiwan's pay-TV market is heavily skewed towards traditional cable-based pay-TV services, with around

77% of pay-TV house holds taking cable. Direct to home (DTH) sat ellite services have a negligible

penetration rate of just 0.4%, according to Media Partners Asia (MPA) , but the growing demand for more

flexible on-demand programming has seen formal IPTV and informal over-the-top (OTT) streaming video

services gain prominence in the last two to three years (16% penetration).

In the cable market, which served just under 6mn subscribers in total at the end of 2012, TBC currently

accounts for a 15% share. Its main rivals are China Network Systems (26%) and Kbro (23%), both of which

serve 1.2mn subscribers. TBC served 751,000 basic cable revenue generating units (RGUs) at the end of

2012 . It remains ahead of Taiwan Fixed Network (TFN) and Taiwan Infrastructure Technologies Corporation

(TINP), among others.

Meanwhile, incumbent telecoms operator Chunghwa Telecom (CHT) served 1.2mn RGUs outside the cable

market using IPTV technology to deliver video services over its broadband infrastructure. CHT's rapid rate of

growth is attributed to the low monthly rates it charges, but with monthly ARPUs well below that of cable

(TWD148 versus TWD524), IPTV remains a relatively low margin business. Another frustration for CHT is

that regulations prohibit it from broadcasting content itself, forcing it to rely on other content providers and

thus giving it relatively limited appeal.

The proceeds from the offering should help Asian Pay Television Trust to improve and broaden its reach and

appeal within the Taiwanese market and perhaps give it greater freedom to consider investing in content

production and overseas acquisitions in order to take advantage of growing demand. Meanwhile, with

demand for video streaming services outpacing investment in content delivery networks and storage in Asia,

we foresee considerable opportunities for the region's REITs to take advantage of investment appetites by

following their peers into the stock market and using the funds to aggressively develop their technology

portfolios, particularly within the datacentre space.